Top 8 Specific Problems of Pricing

Pricing refers to the decision-making process that goes into determining a product or service’s value. The customer will pay the price specified during the pricing procedure for that goods or service. When it comes to pricing, a firm may employ various tactics, but they can all fall under the pricing category.

What Are Price Factors?

Labor, transportation, and material prices are all continually fluctuating in an era of expanding globalization. This is problematic because it introduces new challenges and competitiveness.

Besides, it is also an opportunity because the complexity forces your company to rethink its pricing strategy frequently, aiding in discovering cost-cutting opportunities.

Globalization needs awareness of general economic conditions, differing government economic and taxation policies, new and potential competitors—all of which exert pricing pressure.

As a result, corporations have moved to levers that are more directly under their control—such as cost reduction and better process management, as drivers of profit growth. If this is done correctly, it can maintain prices relatively stable even when margins shift dramatically.

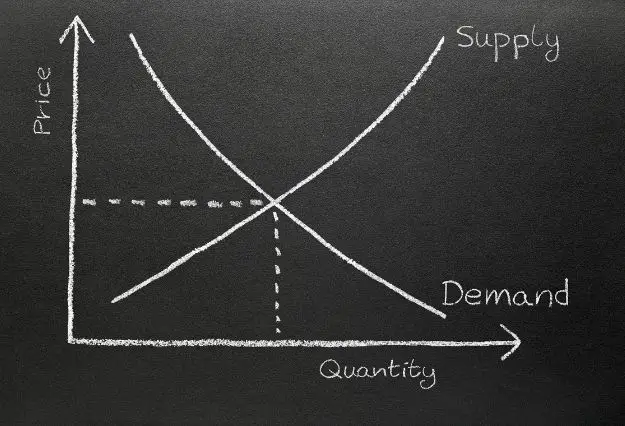

Simple Demand & Supply Equilibrium

However, price consistency may not be the best option for your business. Pricing policy, if appropriately structured—for example, through re-engineering the supply chain and production processes at the same time—can be a strategic opportunity.

Re-engineering reduces expenses while enhancing a company’s products and services by identifying more efficient processes within the company. As economies and new resources become apparent, it may result in downsizing and outsourcing.

What Are the 4 Common Factors Affecting Pricing?

1. Economic Forces

Inflation, salaries, disposable income, and regulation will all influence the market price. Pricing is affected by supply and demand; when supply outnumbers demand, prices decline, and when supply exceeds demand, prices rise.

2. Market Issues

Your pricing decisions will be influenced by market factors such as customer perceptions and purchasing habits. Successful pricing is based on a thorough grasp of the target market’s individual needs and characteristics.

Pricing decisions are influenced by market culture and maturity, and therefore if a specific pricing structure or method is widely accepted, solutions may be limited. Finally, if the market is deteriorating, prices may go down to compete for a shrinking pool of clients.

3. Nature of Competition

Pricing can be a helpful strategy if you are well-positioned to gain a substantial portion of the market. Besides, it can be completely irrelevant if the market is price sensitive and becomes a virtual commodity with many direct competitors.

To avoid this, regardless of how many competitors you have, your product must be distinct in the minds of consumers. Naturally, if there are few direct competitors, pricing decisions may have more flexibility.

4. Production Cost

The final price is influenced by the cost of materials, labor, transportation, processing, marketing, and distribution. After all, costs have been accounted for, the benefits of the product and its value to customers are the key drivers.

What Are the Pricing Opportunities for Your Company

Consider answering the following questions to learn about your company’s pricing opportunities.

- What is the worldwide price position of all products and services to competitors?

- Are clients consulted to assess your goods and services’ perceived value compared to those of your competitors?

- Do you employ value pricing in your company? Is there a clear understanding of what the company considers to be added value against what the client considers additional value? Is there a match between the two?

- Are our pricing policies and practices examined on a regular and thorough basis?

- Is your organization structured in such a way that you can make a “balanced” pricing decision?

- Do you know what your competitors’ pricing methods and plans are for the future?

- Is your company’s pricing approach differentiated for each product group and customer’s unique circumstances and market position?

Top 8 Specific Problems of Pricing

The following points highlight the top eight specific problems of prices.

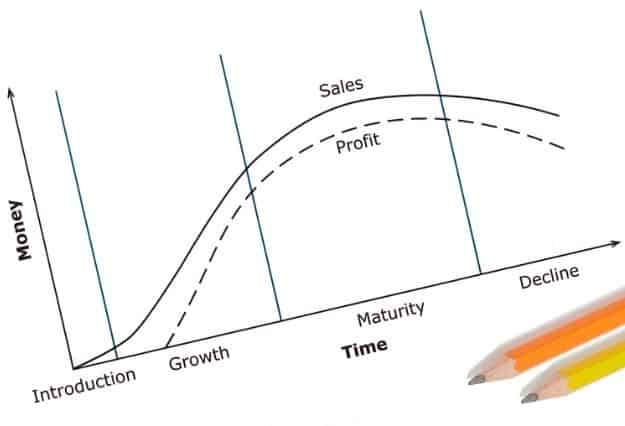

1. Product Pricing During Its Life Cycle

Every product has a life cycle—so sales and profitability fluctuate over time. The product life cycle hypothesis was developed to recognize formally distinct stages in the sales history of representative items.

The pricing strategies and problems must change as the product progresses through each of these stages. There are four stages in a product’s life cycle—it starts with the introduction stage, followed by the growth, then maturity, and finally the decline stage.

The introduction phase is marked by low sales, moderate sales growth, and negative or minimal earnings. The second growth phase is distinguished by two characteristics: rapid sales and significant increases in product profitability.

The third stage entails a slowing of sales growth and a leveling off of profits. The final stage is when both sales and profits begin to decline once more.

It should be emphasized that there is no clear-cut guideline for determining where each stage starts or finishes, and the exact delineation of these stages must be chosen subjectively.

2. The Market’s Growth Rate

Pricing policies, in turn, have a significant impact on this and some items are intrinsically less likely than others to obtain a considerable market share. As a result, these products are inappropriate for a penetration pricing strategy that involves low or negative margins at first.

3. Distinctiveness Is Being Eroded

The rate at which distinctiveness erodes is determined by the quantity of competing products that enter the market and their ability to replicate the attributes of pioneer products.

An analysis of the initial producer’s strengths and weaknesses compared to potential competitors regarding technology and access to distribution channels. Moreover, you can also use financial stability to determine the possible lead time.

Skimming pricing can be reasonable if the lead time is extended. On the other hand, a skimming price may be more appropriate where purchasers are more interested in the product’s attributes, especially its cost, than with the source.

Woolen fabric manufacturers sometimes claim that they cannot maintain the initial price of a new design for an extended period because purchasers soon switch to a new, lower-cost source of supply.

There is also a negative factor: the firm may be more interested in boosting its liquidity situation in the short term than reaping the long-term benefits of a penetration policy.

Finally, although a pioneer product will not generally compete aggressively with existing products, some substitution may occur.

If this substitution is likely to include the producer’s existing items, a penetration price will be less appropriate once more.

4. The Significance of Cost

The cost of manufacturing a product directly impacts its pricing and profit made from each sale. Price refers to a customer’s willingness to pay for a product or service. The difference between the price paid and the costs incurred is referred to as profit.

5. Post-Skimming Strategies

It’s not enough to choose a low price. The timing and size of subsequent price reductions from the original price will have to be decided later. Competitors’ conduct may, in some cases, bind the producer’s hand. Producers may have more leeway in other cases.

If it is determined that the market’s “peak” has been saturated, it is necessary to cut the price to attract new clients.

Another thing to think about is how much the product has developed an image of exclusivity or status. A significant price cut can result in a drop in status, and it might be better to make a series of small price decreases.

6. Mixed Strategies

Many businesses choose a strategy that lies somewhere between the two extremes of skimming and penetration prices. In the case of a large number of new items, many large corporations adhere to this philosophy—Du Pont, for instance, used a hybrid technique for nylon and cellophane.

However, cellophane was closer to the penetration end of the spectrum than nylon, presumably because the cost elasticity of volume output and the price elasticity of expanding demand were both high enough to allow a faster pace of expansion.

In the pricing of a significant piece of farm machinery like the cotton picker, the decision arrived on was a middle ground between the predicted maximum economic value as a substitute for hand labour, and a sufficiently low price to assure widespread adoption,

7. Pricing in Maturity

It keeps companies from becoming comfortable after introducing successful items by reminding them that they need to have additional products ready to market when their current products begin to decline.

Another weakness in the product-life-cycle idea is that it implies a decline stage that will automatically follow maturity. However, maturity can be extended for many years in some markets by a succession of product innovations.

Besides, you can extend maturity in some markets because the product meets a basic need for no close substitute.

Even though the market elasticity of demand may be low, it is vital to consider cost conditions. If cost continues to reduce with an increase of output owing to the learning effect, there will be pressure for a price reduction.

When there are considerable cost differences but little room for cost cuts, lowering prices puts further pressure on the margins of high-cost companies, which may be forced out of the market.

Besides, if the low-cost firm decides to take a wait-and-see approach, it will keep its prices the same, maybe using the higher short-run earnings to invest in product differentiation activities.

8. Pricing Products in Decline

At this stage of decline, there are three additional techniques to consider:

- Product Reformulation Strategy

First, the product must be radically reformulated and sold at a considerably lower price. This is a regular procedure in the book business when a hard-bound edition’s market saturation signals the arrival of a paperback edition.

- Price Reduction Strategy

The second technique entails significantly lowering prices to stimulate a brief sales rebound. This occurred in the instance of the Ford Anglia in the United Kingdom, whose popularity had declined due to improvements in appearance and performance in competing models.

Bottom Line

Pricing strategies are an essential part of a business’s overall strategy. Before you start your investigation, have it in mind that different people perceive price in various ways.

You will strengthen your whole pricing strategy if you have a good grasp and control of consumers’ reference prices.

Measuring price sensitivity and assessing actual purchase behavior and consumer preferences and intentions can be done using various quantitative methods.